Taxes

Purpose

To assign GL accounts to each tax used by your business.

Procedure

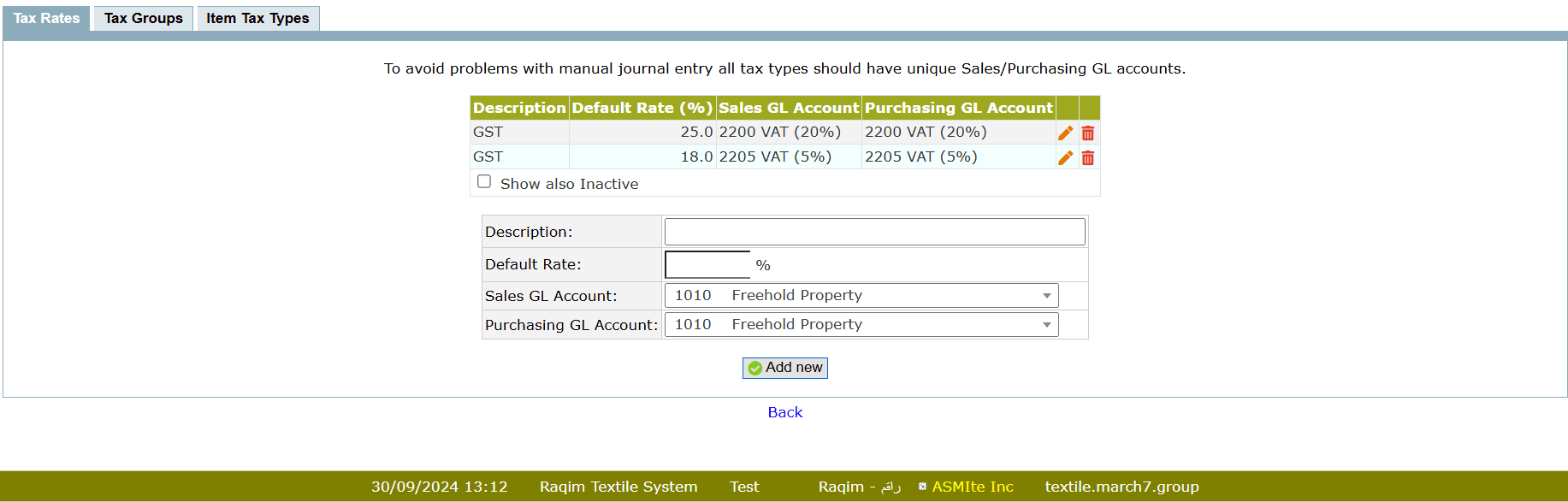

Tax Rates

- Enter the Tax Description

- Enter the Default Percentage Rate of the Tax

- Select the Associated Sales GL Account from the drop-down list

- Select the Associated Purchasing GL Account from the drop-down list

- Click Add New

- Once this is complete, you should setup your Tax Groups and Item Tax Types

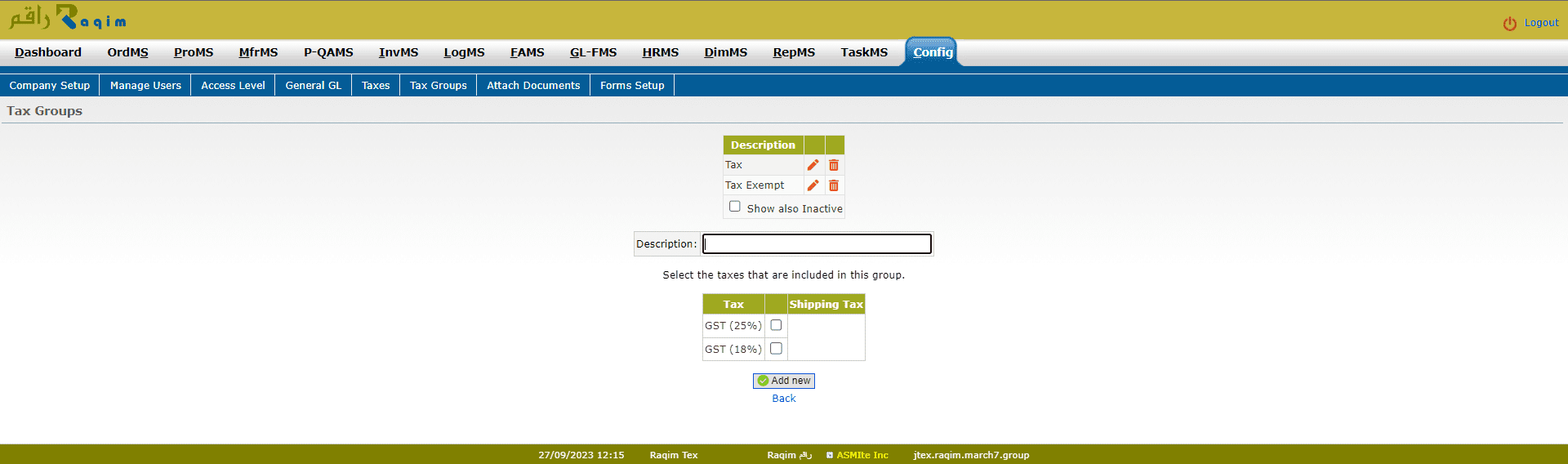

Tax Groups

- Create Tax Groups to define which tax rates are applicable to customers in given group

- The Shipping Tax signifies which tax group should be applied to shipping for billing purposes. Only one group may be designated for shipping at a time

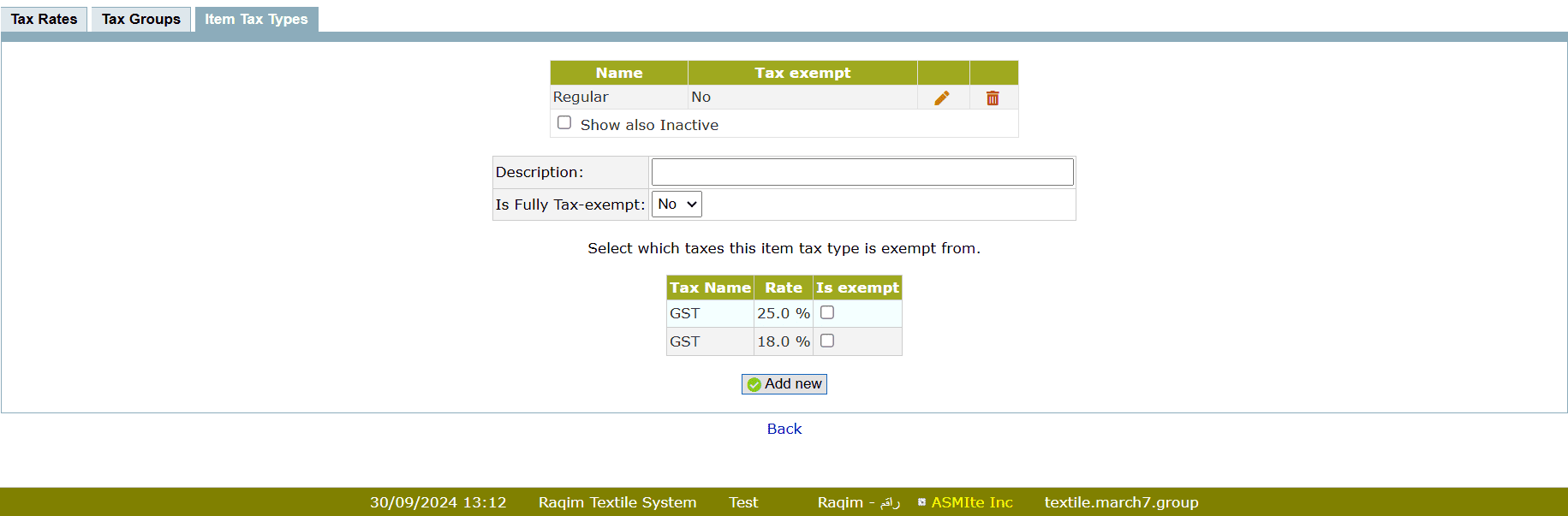

Item Tax Types

- Your country, state or province may have specific tax rules for different types of items. In order to make sure taxes are applied correctly to each individual item being sold, define Item Tax Types by category. This differs from Tax Groups which apply to customers.

- For example, clothing sold for school-age children may be exempted from a state or provincial tax but not federal tax. To achieve this, simply create a category and tick off the taxes which are exempt. If the category is exempt from all taxes, set the Is exempt? flag to yes.